Posts Tagged ‘Electricity’

PJM 2026/2027 and 2027/2028 Capacity Base Residual Auctions – Update

PJM 2026/2027 and 2027/2028 Capacity Base Residual Auctions – Update. In our previous article, we reported on PJM’s 2025/2026 Capacity Base Residual Auction results. After collaboration with stakeholders, and review by the Federal Energy Regulatory Commission (FERC), PJM recently announced the following updates. These updates are meant to address resource adequacy issues resulting from tightening…

Read MorePJM 2025/2026 Capacity Base Residual Auction Results

PJM 2025/2026 Capacity Base Residual Auction Results PJM recently concluded its capacity Base Residual Auction (BRA) for Planning Year (PY) 2025/26. The resulting prices, compared to previous recent auctions, are significantly higher. For PY 2024/25, the RTO capacity price is $28.92/MW-day. For PY 2025/26, the RTO capacity price cleared at $269.92/MW-day, a more than nine-fold…

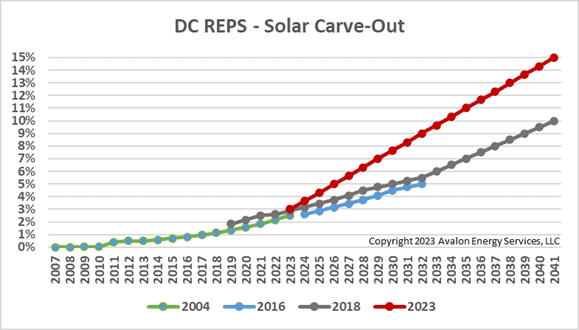

Read MoreDistrict of Columbia Solar Carve-Out

District of Columbia Solar Carve-Out Background Late last year, the DC Council passed The Local Solar Expansion Act. It was signed into law by the Mayor on January 10, 2023. The Bill is currently in the 30-day Congressional review process for new DC laws. The law will go into effect on the later of March…

Read MoreWhat a Difference a Year Makes

What a Difference a Year Makes Last September, our COO, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic was State of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on…

Read MoreElectricity and Rock: Still Not Friends

By Evelyn Teel In a previous blog post, we discussed findings from the U.S. Geological Survey (USGS) that the I-95 corridor is particularly at risk of grid outages in the event of a geomagnetic storm. You can read that blog post here: https://avalonenergy.us/2018/07/electricity-meet-rock/. Further research has been conducted, and a new report from the USGS…

Read MoreWind Power, Transmission Lines, and a Vision for a Better Electric Grid

By Evelyn Teel Wind energy is an incredible resource with incredible potential. The generation costs are low, the efficiency of turbines continues to increase, and the threat to birds continues to decline. An unfortunate irony, however, is that the places with the most prolific wind energy tend to be places with relatively little demand for…

Read MoreAvalon Energy Services Turns 10 Years Old This Month

Late 2008/early 2009 was an unsettling time. Bear Stearns was bailed out, Lehman Brothers went bankrupt, the housing market collapsed, credit markets were frozen, the stock market fell more than 40%, the unemployment rate was approaching 10%, and energy markets were in turmoil. The Great Recession was underway. Despite this uncertainty, during April of 2009,…

Read MoreMaryland Renewable Energy Portfolio Standard (RPS) – Veto Override

Last week, the Maryland House and Senate voted to override Governor Larry Hogan’s 2016 veto of the 2016 Clean Energy Jobs bill. As a result, Maryland’s Renewable Energy Portfolio Standard (RPS) will increase from 20% in 2022 to 25% in 2020. The graph below shows the effect of the original RPS rule in blue overlaid…

Read MoreSeparate Paths – Part 2

By Ana Rasmussen, Intern Our last blog post Separate Paths – Part 1looked at how electricity distribution costs have been rising since 2008 and many of our readers have had questions about just why this is happening. In order to explore this, and to try to get some answers, I dove in and analyzed seven…

Read MoreSeparate Paths – Part 1

By Ana Rasmussen, Intern Since the shale boom began in earnest during 2008, natural gas prices in the US wholesale market have fallen dramatically. Prices have hovered within the 2 to 6 dollar per million Btu (mmBtu) range over the last few years, with the prompt month NYMEX natural gas contract trading at a remarkably…

Read More