Prices

Market Update

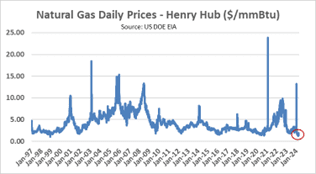

A Tale of Two Natural Gas Frequently, we are asked, “With natural gas prices so low, why aren’t electricity prices low?” You may remember that, in the Mid-Atlantic, natural gas is often the marginal fuel used to generate electricity and thus generally sets electricity prices in the wholesale market. Well, natural gas prices are low. …

Read MoreMarket Update

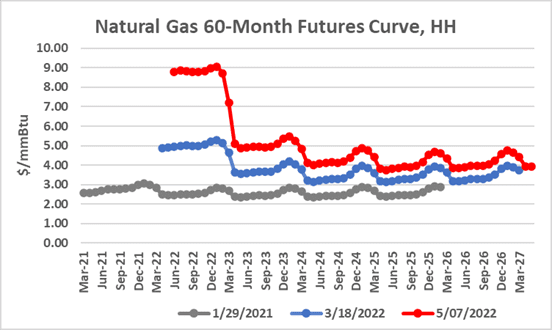

Market Update We looked at natural gas prices during mid-March compared to prices during the pandemic. The graph below plots forward natural gas prices at two points in time. The grey line represents the forward curve as of January 29, 2021 and the blue line as of March 18, 2022. It is important to note…

Read MoreWhat a Difference a Year Makes

What a Difference a Year Makes Last September, our COO, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic was State of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on…

Read MoreIn the News: Jim McDonnell Talks Energy Markets and Covid-19

By Evelyn Teel Our Chief Operating Officer, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic wasState of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on the differential impact of…

Read MoreWelcome Back to 1976

By Evelyn Teel and Jim McDonnell Our last blog post discussed the trend of decreasing natural gas prices in the 2010s (please find that blog post at this link: https://avalonenergy.us/2020/01/down-down-down-energy-prices-in-the-2010s/). What does the trend in natural gas prices look like if we go further back in time? To answer this question, we extended our look-back…

Read MoreDown, Down, Down: Energy Prices in the 2010s

By Evelyn Teel A previous blog post highlighted the shale gas revolution as arguably the most significant energy-related development of the previous decade (you can find the post here: https://avalonenergy.us/2019/12/shale-we-review-the-2010s/). In this article, we will discuss another trend that was significant in the 2010s – declining energy prices. Natural Gas Prices One major effect of…

Read MoreShale We Review the 2010s?

By Evelyn Teel and Jim McDonnell With the decade coming to a close, this is a perfect opportunity to look back at how the energy market has changed over the past ten years. It has certainly been a whirlwind ride, starting shortly after the 2008 stock market crash and continuing through the Great Recession and…

Read MoreMaryland Renewable Energy Portfolio Standard – A Lot of Change for No Action

During this year’s legislative session, the Maryland General Assembly passed the Maryland Clean Energy Jobs Act. Maryland’s governor, Larry Hogan, then had until 30 days after the legislative session (i.e., until May 30) to sign the bill, veto the bill, or take no action. By taking no action, the bill would automatically become law. The…

Read MoreAvalon Energy Services Turns 10 Years Old This Month

Late 2008/early 2009 was an unsettling time. Bear Stearns was bailed out, Lehman Brothers went bankrupt, the housing market collapsed, credit markets were frozen, the stock market fell more than 40%, the unemployment rate was approaching 10%, and energy markets were in turmoil. The Great Recession was underway. Despite this uncertainty, during April of 2009,…

Read MoreNew England Electricity Rates: Quite a Difference

By Jim McDonnell and Evelyn Teel, Avalon Energy Services, LLC Compared to the rest of the United States, electricity prices in New England are high. Nothing surprising there. So, just how expensive are they? Well, it depends. And, the surprising part is which utility, in one comparison, has the lowest rates. First, some background. Eversource…

Read More