Solar

District of Columbia Solar Carve-Out

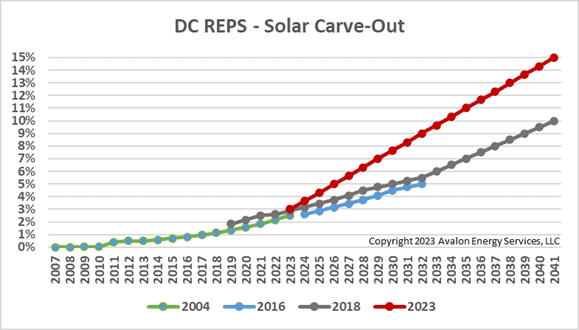

District of Columbia Solar Carve-Out Background Late last year, the DC Council passed The Local Solar Expansion Act. It was signed into law by the Mayor on January 10, 2023. The Bill is currently in the 30-day Congressional review process for new DC laws. The law will go into effect on the later of March…

Read MoreDistributed Energy Resources Give You Options

By Evelyn Teel In the earliest days of electricity, generation happened close to where the electricity was used. A small hydro facility might have been used to power a single factory, or a coal-fired generator might have electrified a small town. As demand for electricity grew and we developed the capability to move it over…

Read MoreIn the News: Jeff Dowdell Talks CHP, Natural Gas, and More

By Evelyn Teel Avalon Energy Services Senior Energy Consultant Jeff Dowdell was the featured guest on the most recent Energy Sense Podcast. Check out the episode to learn about combined heat and power (CHP) – what it is, how it can reduce costs and improve efficiency, and how it improves resilience. Jeff also discusses the…

Read MoreNCAC – 22nd Annual Washington Energy Policy Conference

ONE WEEK FROM TODAY Secure your spot here: https://www.ncac-usaee.org/event-2845352 Energy Technologies and Innovations: A Disturbance in the [Market] Force Thursday, April 12, 2018, 8:30 AM to 6:00 PM The George Washington University Keynote speakers: Mark P. Mills, Senior Fellow, Manhattan Institute Gil Quiniones, President and CEO, New York Power Authority In addition to these keynote…

Read MorePeak Oil

Concerns and worry about Peak Oil are overstated and irrelevant. Many articles and books have been written on the topic and many lectures given. Dire predictions have been made and many people have concluded that because of peaking of crude oil production, the future of the human race is bleak. Peak Oil theory seems so…

Read MoreCapacity Factor – Part 2

In our previous article we looked at Capacity Factor and how it differs between nuclear generation and solar PV (photovoltaic). We concluded that in order to generate the same amount of electricity as 1/3 of the capacity of the US nuclear generation fleet (33,042 MW), 154,760 MW of solar PV capacity would be required. This…

Read MoreCapacity Factor

In a recent article in the Energy Law Journal, the authors state, By as early as 2016, installed distributed solar PV capacity in the United States could reach thirty gigawatts (GW). If that forecast is on track, distributed solar generation will have increased from less than one GW in 2010 to the equivalent of nearly…

Read More