Electricity

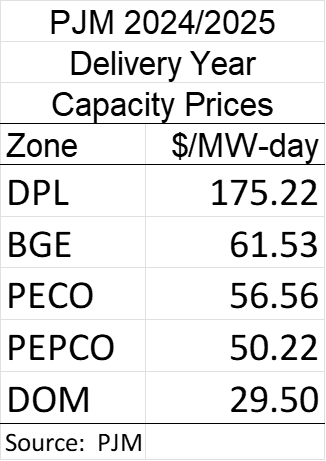

Capacity Prices Rise on the Delmarva Peninsula

Capacity Prices Rise on the Delmarva Peninsula The PJM Interconnection is the power grid operator in the Mid-Atlantic, an area that covers 65 million people in all or part of 13 states and the District of Columbia. PJM is broken up into “control zones,” one of which is the DPL zone. The DPL zone…

Read MoreMarket Update

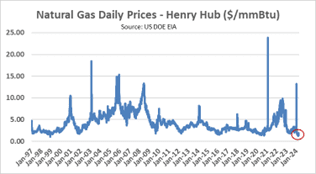

A Tale of Two Natural Gas Frequently, we are asked, “With natural gas prices so low, why aren’t electricity prices low?” You may remember that, in the Mid-Atlantic, natural gas is often the marginal fuel used to generate electricity and thus generally sets electricity prices in the wholesale market. Well, natural gas prices are low. …

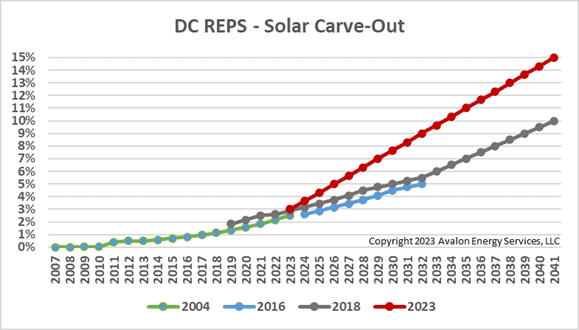

Read MoreDistrict of Columbia Solar Carve-Out

District of Columbia Solar Carve-Out Background Late last year, the DC Council passed The Local Solar Expansion Act. It was signed into law by the Mayor on January 10, 2023. The Bill is currently in the 30-day Congressional review process for new DC laws. The law will go into effect on the later of March…

Read MoreMarket Update

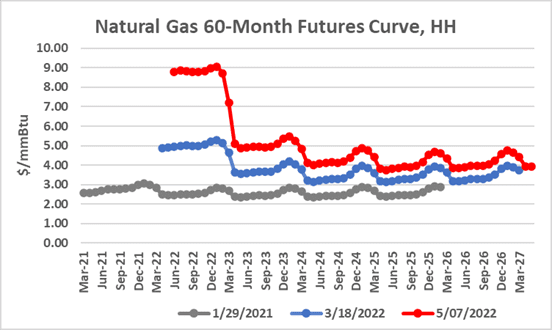

Market Update We looked at natural gas prices during mid-March compared to prices during the pandemic. The graph below plots forward natural gas prices at two points in time. The grey line represents the forward curve as of January 29, 2021 and the blue line as of March 18, 2022. It is important to note…

Read MoreWhat a Difference a Year Makes

What a Difference a Year Makes Last September, our COO, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic was State of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on…

Read MoreIn the News: Jim McDonnell Talks Energy Markets and Covid-19

By Evelyn Teel Our Chief Operating Officer, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic wasState of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on the differential impact of…

Read MoreEnergy Concepts: Power versus Energy

It is often tempting to use the words “power” and “energy” interchangeably. However, they are not, in fact, synonyms. In this blog post, we are going to share a brief explanation of the difference between the two. Fundamentally, power refers to a rate while energy refers to an amount. Power is a measure of energy…

Read MoreElectricity and Rock: Still Not Friends

By Evelyn Teel In a previous blog post, we discussed findings from the U.S. Geological Survey (USGS) that the I-95 corridor is particularly at risk of grid outages in the event of a geomagnetic storm. You can read that blog post here: https://avalonenergy.us/2018/07/electricity-meet-rock/. Further research has been conducted, and a new report from the USGS…

Read MoreDistributed Energy Resources Give You Options

By Evelyn Teel In the earliest days of electricity, generation happened close to where the electricity was used. A small hydro facility might have been used to power a single factory, or a coal-fired generator might have electrified a small town. As demand for electricity grew and we developed the capability to move it over…

Read MoreDown, Down, Down: Energy Prices in the 2010s

By Evelyn Teel A previous blog post highlighted the shale gas revolution as arguably the most significant energy-related development of the previous decade (you can find the post here: https://avalonenergy.us/2019/12/shale-we-review-the-2010s/). In this article, we will discuss another trend that was significant in the 2010s – declining energy prices. Natural Gas Prices One major effect of…

Read More