Energy

PJM 2026/2027 and 2027/2028 Capacity Base Residual Auctions – Update

PJM 2026/2027 and 2027/2028 Capacity Base Residual Auctions – Update. In our previous article, we reported on PJM’s 2025/2026 Capacity Base Residual Auction results. After collaboration with stakeholders, and review by the Federal Energy Regulatory Commission (FERC), PJM recently announced the following updates. These updates are meant to address resource adequacy issues resulting from tightening…

Read MorePJM 2025/2026 Capacity Base Residual Auction Results

PJM 2025/2026 Capacity Base Residual Auction Results PJM recently concluded its capacity Base Residual Auction (BRA) for Planning Year (PY) 2025/26. The resulting prices, compared to previous recent auctions, are significantly higher. For PY 2024/25, the RTO capacity price is $28.92/MW-day. For PY 2025/26, the RTO capacity price cleared at $269.92/MW-day, a more than nine-fold…

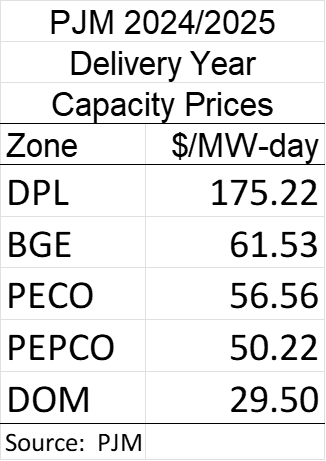

Read MoreCapacity Prices Rise on the Delmarva Peninsula

Capacity Prices Rise on the Delmarva Peninsula The PJM Interconnection is the power grid operator in the Mid-Atlantic, an area that covers 65 million people in all or part of 13 states and the District of Columbia. PJM is broken up into “control zones,” one of which is the DPL zone. The DPL zone…

Read MoreMarket Update

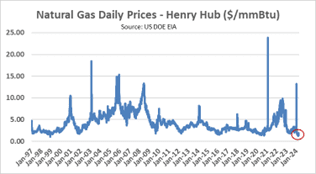

A Tale of Two Natural Gas Frequently, we are asked, “With natural gas prices so low, why aren’t electricity prices low?” You may remember that, in the Mid-Atlantic, natural gas is often the marginal fuel used to generate electricity and thus generally sets electricity prices in the wholesale market. Well, natural gas prices are low. …

Read MoreAvalon Energy Services Sponsors Maryland Clean Energy Summit

Avalon Energy Services, LLC was a sponsor of last week’s Maryland Clean Energy Summit held in College Park. Hosted by the Maryland Clean Energy Center (MCEC), this regional conference brought together forward thinkers in the energy industry for important conversations and thought-provoking presentations. The event was attended by over 400 individuals. The mission of the…

Read MoreFar Below Cayuga’s Waters

Far Below Cayuga’s Waters By Caitlin McDonnell The conversation around increasing the percentage of renewable energy in the generation mix continues to grow larger, and more complex. As you may recall from our previous post on geothermal energy, wind and solar, while the most frequently cited renewable energy sources, face the challenge of intermittency. Without…

Read MoreMarket Update

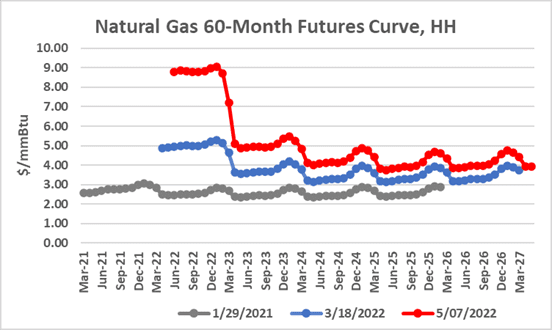

Market Update We looked at natural gas prices during mid-March compared to prices during the pandemic. The graph below plots forward natural gas prices at two points in time. The grey line represents the forward curve as of January 29, 2021 and the blue line as of March 18, 2022. It is important to note…

Read MoreWhat a Difference a Year Makes

What a Difference a Year Makes Last September, our COO, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic was State of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on…

Read MoreIn the News: Jim McDonnell Talks Energy Markets and Covid-19

By Evelyn Teel Our Chief Operating Officer, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic wasState of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on the differential impact of…

Read MoreEnergy Concepts: Power versus Energy

It is often tempting to use the words “power” and “energy” interchangeably. However, they are not, in fact, synonyms. In this blog post, we are going to share a brief explanation of the difference between the two. Fundamentally, power refers to a rate while energy refers to an amount. Power is a measure of energy…

Read More