Savings

District of Columbia Solar Carve-Out

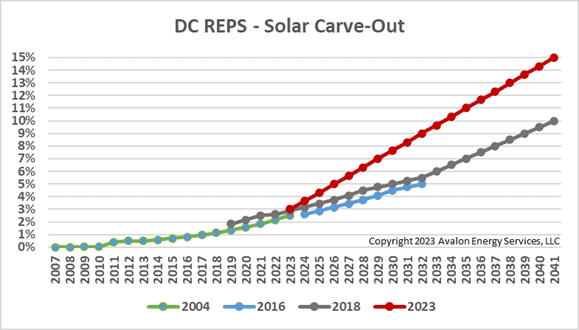

District of Columbia Solar Carve-Out Background Late last year, the DC Council passed The Local Solar Expansion Act. It was signed into law by the Mayor on January 10, 2023. The Bill is currently in the 30-day Congressional review process for new DC laws. The law will go into effect on the later of March…

Read MoreWhat a Difference a Year Makes

What a Difference a Year Makes Last September, our COO, Jim McDonnell, was the lead-off speaker for the first session of the Maryland Clean Energy Center’s Energy Economy Speaker Series. The topic was State of the Sector: Impacts of Covid-19 on the Energy Economy. Jim provided a broad energy market update and then focused on…

Read MoreBuilding Ventilation and COVID-19

By Evelyn Teel COVID-19 has upended many facets of our lives, from where and how people work, to how children are educated, to how we socialize. As we try to find ways to get life back to normal, experts have been rethinking everything from the way schools are laid out to the way we order…

Read MoreIn the News: Jeff Dowdell Talks CHP, Natural Gas, and More

By Evelyn Teel Avalon Energy Services Senior Energy Consultant Jeff Dowdell was the featured guest on the most recent Energy Sense Podcast. Check out the episode to learn about combined heat and power (CHP) – what it is, how it can reduce costs and improve efficiency, and how it improves resilience. Jeff also discusses the…

Read MoreMaryland Renewable Energy Portfolio Standard (RPS) – Veto Override

Last week, the Maryland House and Senate voted to override Governor Larry Hogan’s 2016 veto of the 2016 Clean Energy Jobs bill. As a result, Maryland’s Renewable Energy Portfolio Standard (RPS) will increase from 20% in 2022 to 25% in 2020. The graph below shows the effect of the original RPS rule in blue overlaid…

Read MoreThese Are Days To Remember

Natural gas prices are really, really low in the wholesale market. The graph above shows daily natural gas prices traded at the Henry Hub, in dollars per million British thermal units ($/mmBtu), from January 1997 to today. Prices on the graph are in nominal dollars, not adjusted for inflation. Natural gas prices have exhibited a…

Read MoreIn The News – Avalon Energy Services

Avalon Energy Services recently completed an electricity procurement project for KBS Capital Advisors’ One Washingtonian Center property in Gaithersburg, MD. Marc Deluca, Regional President of KBS, noted that “Electricity markets have exhibited extreme volatility. The folks at Avalon Energy Services have deep expertise and an unsurpassed understanding of the energy markets and how they work.…

Read More40% Reduction and Volatility Avoided

Our recent press release was picked up by numerous news outlets. Click here to see how it was reported by the Wall Street Journal’s Market Watch. In summary, Avalon Energy Services, LLC and our project partner, Ameresco, successfully completed a second natural gas procurement process for the District of Columbia Department of General Services (DC…

Read MoreMarket Update, November 6, 2013

For buyers, pricing in the wholesale natural gas market is attractive. The graph below shows natural gas prices over the past ten years. While we are not at the absolute low, we are near the bottom. The next graph shows the 24 month forward curve for natural gas. The line is upward sloping, meaning the…

Read MoreReal Energy Cost Savings

Below are the results from a sampling of reverse auctions conducted for Avalon Energy Services’ customers, including customers of varying size, over the past few months. The first graph shows the customer’s annual energy costs before competitive bidding (blue line) and after contracts were executed on accepted bids (red line). Pre-auction annual energy costs ranged…

Read More