Natural Gas and Electricity Are Parting Ways – Part 1

In recent articles, we have explored the dramatic decline in natural gas prices over the past seven years. See These Are Days To Remember and10,000 Maniacs Were Right.

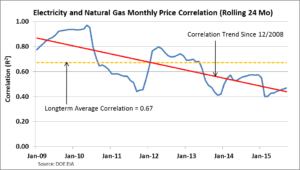

In the US Mid-Atlantic, natural gas and electricity prices have, over time, tended to move together. While there has by no means been a perfect correlation between the two, the relationship has been strong.

Over the past 15 years, the coefficient of determination (R2) has averaged about 67% (see yellow line). In other words, over this time period, 2/3 of the change in electricity prices can be explained by changes in natural gas prices. More recently, however, the strength of this relationship has weakened and continues to weaken further (see red line). Electricity prices have declined but not as precipitously as those of natural gas.

Why has this relationship weakened? Two significant drivers relate to (i) dispatch order and (ii) capacity prices.

Dispatch Order

In scheduling energy to serve electricity users, the grid operator, PJM, utilizes a least-cost dispatch model. PJM develops an expectation of projected system load on an hourly basis and then seeks bids from generators to supply energy to serve this load. After bids have been submitted, for each hour, PJM accepts the lowest cost offers first and then works their way through higher price offers until sufficient supply has been cleared to match the projected load. (There are a number of system constraints and complications that must be incorporated into the process, but this pretty much captures it.) For each hour, the price at which the last megawatt-hour (MWh) clears sets the price for all the supply offers that clear in that hour.

For many years, the last generating units cleared were generally natural gas-fired units. As a result, it has been these natural gas units that have set the price for electricity, leading to the strong link between natural gas prices and electricity prices. A common understanding was that “as natural gas prices go, so go electricity prices.”

But now, low natural gas prices are leading to lower and lower supply bids by natural gas-fired generators, causing them to more frequently fall down the dispatch order and clear before coal-fired units. Because of this, coal fired units are now more often becoming the marginal, or price-setting, units. And, as a result, falling natural gas prices have not driven down electricity prices to the extent they once would have.

In addition to procuring energy, electricity wholesale suppliers must also own or procure capacity. In our next article, we will look at how capacity costs influence electricity prices.

Evelyn Teel contributed to this article.

The Avalon Advantage– Visit our website atwww.AvalonEnergy.US, call us at 888-484-8096, or email us atjmcdonnell@avalonenergy.us. Please feel free to share this article. If you do, please email or post the web link. Unauthorized copying, retransmission, or republication is prohibited. Copyright 2015 by Avalon Energy®Services LLC