Natural Gas and Electricity Are Parting Ways – Part 2

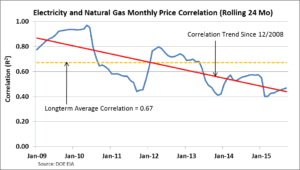

In our last article, Natural Gas and Electricity Are Parting Ways – Part 1, we explored the weakening correlation between wholesale natural gas prices and electricity prices in the Mid-Atlantic. While natural gas prices have fallen dramatically over the past seven years, and electricity prices have fallen as well, electricity prices have not fallen as far. We discussed how this weakening relationship is, in part, a result of natural gas-fired generating units more and more often being dispatched before coal-fired units. In this article, we look at the influence of capacity prices.

Capacity

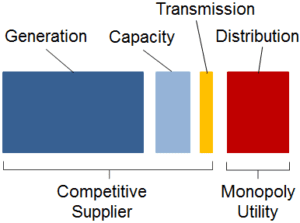

The cost of energy delivered by a competitive supplier consists of several elements–generation, capacity, transmission, and ancillary services. Costs to suppliers resulting from PJM’s energy auctions are reflected in competitive suppliers’ generation charges. Competitive suppliers are also required to own or to reserve generation capacity. PJM runs separate capacity auctions to place a price on this capacity. These auctions establish capacity prices for each of the three consecutive future planning years.

Polar Vortex

During the depths of the Polar Vortex of January 2014 (see What Does Volatility Look Like?), there were times when more than 20% of generation capacity in PJM was unable to respond when dispatched by the grid operator. The grid operator then had to call upon non-economic (meaning more costly) resources to fill in, some of which also were unable to respond. The grid came within a few thousand megawatts of brownouts, and prices soared to more than $2,600 per megawatt hour during some hours.

Capacity Performance

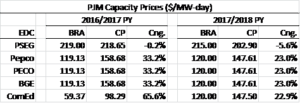

Clearly more reliable generation capacity was required. PJM proposed, and the Federal Energy Regulatory Commission (FERC) approved, a change in regulation creating a new Capacity Performance product. With Capacity Performance, PJM established new, more stringent requirements for generation regardless of weather conditions and system conditions, and also established onerous penalties in the event that generation does not respond when called. Most generators bid their capacity again during two Transitional Auctions, for the planning years 2016/2017 and 2017/2018. As a result, due to this change in regulation, capacity prices have been reset higher for each of these two planning year periods.

The table above presents, for the 2016/2017 and 2017/2018 planning years, capacity prices that were originally established as part of Base Residual Auctions (BRA) and the new prices established as part of Capacity Performance (CP) Transition Auctions.

Additional investment was clearly needed in order to improve system reliability. PJM’s strategy with Capacity Performance is, on the one hand, to provide generators “resources to invest in improvements in such areas as dual-fuel capability, securing firmer natural gas supplies and upgrading plant equipment,” while, on the other hand, imposing substantial penalties for non-performance.

These increased costs associated with Capacity Performance, which will be reflected in electricity prices, are unassociated with changes in natural gas prices and are another driver of the decline in correlation between electricity prices and natural gas prices.

Notes:

– Evelyn Teel contributed to this article

– Capacity prices and quote from PJM website

The Avalon Advantage– Visit our website atwww.AvalonEnergy.US, call us at 888-484-8096, or email us atjmcdonnell@avalonenergy.us. Please feel free to share this article. If you do, please email or post the web link. Unauthorized copying, retransmission, or republication is prohibited. Copyright 2015 by Avalon Energy®Services LLC