OFO (No Room at the Inn)

Huh? What does OFO mean? First, a step back.

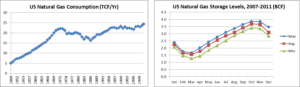

The US natural gas pipeline and distribution system can be thought of as a large container with producers injecting natural gas (supply) and customers withdrawing natural gas (demand). Last year, during 2011, the US consumed 24.4 trillion cubic feet (TCF ) of natural gas, or, on average, about 67 billion cubic feet (BCF) per day.

Interconnected with the US pipeline system is about 4 TCF of working gas storage capacity that is used to help balance supply and demand. Generally, natural gas is injected into storage during the summer and fall and withdrawn during periods of peak winter demand. Formation pressure from natural gas wells along with pressure added to the systems by mechanical compressors (driven by reciprocating engines and gas turbines) move natural gas through the pipeline and distribution systems. There are times when customers take more natural gas out of the pipeline and distribution network than is being injected by production wells or from storage. This can occur during prolonged cold spells and when surface equipment associated with production wells freezes over, for example. In these cases, the result will be a decline in system pressure. As system pressure drops, the ability to deliver natural gas to all customers diminishes. Systems operators have several tools available to manage pipeline pressure, including using “line pack” or also interrupting service to some customers. However, during extreme conditions, these tools may not be enough to maintain system pressure and operators may resort to an Operational Flow Order (OFO).

An OFO is an order to transportation customers and their suppliers that they together must keep the amount of natural gas they inject into the system within a tight limit compared to the amount of natural gas a customer burns. If injections for a customer fall below the threshold compared to actual burns, penalties are applied which, in the worst case, can be substantial.

So far, the 2011/2012 winter has not been very cold. Why, then, would a discussion of OFOs be of interest today?

On Friday, March 16, Delmarva Power (which operates a natural gas distribution system) issued an Operational Flow Order “until further notice.” This OFO was issued “due to warmer than normal weather conditions…and the inability to inject gas into storage.” So, here we are still in the winter heating season, when distribution companies are normally withdrawing natural gas from storage, and Delmarva has run out of storage capacity into which to inject natural gas. Rather than being concerned that system pressure will drop to an unacceptably low level, the concern is that system pressure will RISE to an unacceptably HIGH level.

Rather than being concerned that customers will withdraw more natural gas from their system than is delivered into their system, in their OFO, Delmarva indicates that “customers may deliver no more than one hundred and five percent (105%) of the volumes of gas tendered for burn by the customer on a daily basis, net of losses and unaccounted-for gas.”

Because deliveries are scheduled in advance (“nominated”) and because actual usage can vary significantly due to changes in weather and other factors, this is a tight threshold on a short cycle (daily) basis.

And what if a customer over delivers? Delmarva’s OFO states, “For all such … over-delivery volumes, a charge of THIRTY FIVE DOLLARS ($35.00) per MCF will be applied…” (emphasis added).

Currently, Delmarva’s commodity cost rate is $5.28 per MCF. This means the penalty is 563% of the cost of delivered natural gas. If you file your taxes late, you may be subject to a 10% penalty. If you deliver natural gas over the threshold into the Delmarva system, the penalty is more than SIX-FOLD the commodity cost of natural gas.

OFOs, when they are issued, occur during the winter. OFOs issued to ensure adequate delivery of natural gas during times of exceptionally cold weather do occur but are infrequent. OFOs, such as this one, issued during winter time to ensure that excess deliveries are not made are highly unusual. An employee of another East Coast natural gas utility indicated that over the company’s life, there has never been an OFO related to reducing system pressure during the winter time. The size of the penalties in the case being discussed here is a measure of how significant the current oversupply situation is.

What is driving this situation? Simply put, the combination of unusually warm weather this winter and diminished industrial demand for natural gas has created a large natural gas surplus. Normally, imbalances can be managed with storage. But, this year, there is no room at the Inn. Storage levels are far too high. There is nowhere for the natural gas to go.

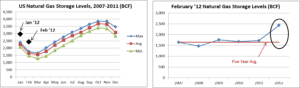

Below are updates to two graphs presented in a previous blog post (https://avalonenergy.us/2012/02/how-low-can-they-go/).

Natural gas storage levels remain excessively high. And, as noted previously, the gas cannot stay in storage until next winter because the reservoirs need to be cycled down. As we predicted, this “overhang” continues to keep downward pressure on natural gas prices. On Friday, the April 2012 natural gas futures contract closed at $2.33 per dekatherm (Dth) and the twelve month strip at $2.92/Dth.

The Avalon Advantage – Visit our website at www.avalonenergy.us, call us at 888-484- 8096, or email us at jmcdonnell@avalonenergy.us.

Copyright 2012 by Avalon Energy® Services LLC