Market Update

A Tale of Two

Natural Gas

Frequently, we are asked, “With natural gas prices so low, why aren’t electricity prices low?”

You may remember that, in the Mid-Atlantic, natural gas is often the marginal fuel used to generate electricity and thus generally sets electricity prices in the wholesale market.

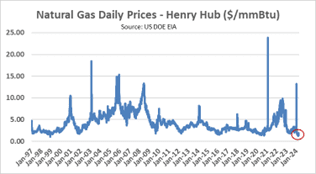

Well, natural gas prices are low. In the short-term, anyway. Natural gas prices reached a multi-year low, sinking to $1.58/mmBtu, in late February. Today, the prompt month natural gas futures contract (for delivery next month) remains near $2.00/mmBtu.

The major factors that have driven natural gas prices down, and continue to keep them low, are:

- The 2023/2024 winter was the warmest over the past 129 years, according to NOAA

- Natural gas production is about 100 Bcf/day, which is close to its record high level

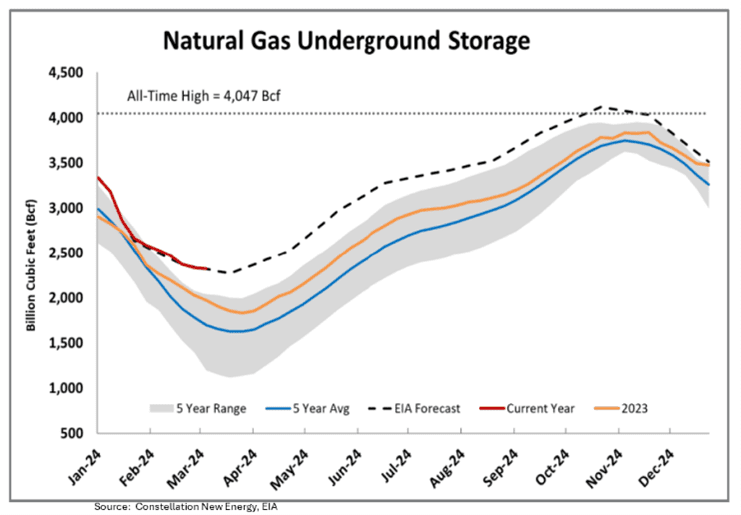

- Natural gas storage levels are high, running 37% above the 5-year average

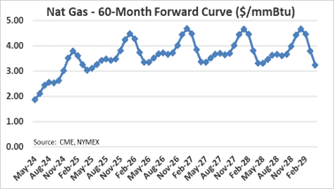

But low near-term natural gas prices are leading producers to reduce spending and cut back on drilling and future production. A hot summer will provide support for natural gas prices due to the increasing use of natural gas peaker plants for electricity generation. Medium and longer-term supply cutbacks and demand increases have resulted in a forward curve that is in “contango,” meaning contracts for delivery of natural gas further out in time are trading at significantly higher prices – in the $3.50 to $4.50/mmBtu range.

Other demand factors supporting higher medium- and long-term natural gas prices are:

- Growing liquified natural gas (LNG) exports to Europe and Asia

- 14.5 Bcf/day in service today, with more than 10 Bcf/day coming online by 4Q 2027 despite “DOE Pause”

- “Re-shoring” of manufacturing back to US soil and the related increasing demand for natural gas

- Rising natural gas pipeline exports to Mexico

Electricity

Demand for electricity is increasing rapidly, while increases in supply (generation) are much more constrained.

Forecasted growth in demand for electricity in the US has more than doubled recently compared to historical growth rates. This increase in growth is driven by:

- Expanding development of artificial intelligence and expansion of crypto mining, and the related buildout of new and larger data centers

- Electric vehicle (EV) mandates and incentives

- Re-shoring of manufacturing

- Incentivized installation of electric powered heat pump technology

- Overall trend towards the electrification of our economy

It has been reported that 24 gigawatts (1 GW = 1,000 MW) of new data center load is expected to be developed in northern Virginia’s “data center alley,” the equivalent of the output of 30 North Anna nuclear power plants. It is worth noting that data centers, as well as other energy-intensive applications, represent a temporal mismatch, in that they can come online relatively quickly, whereas new power generation takes years.

The expansion of the generation fleet is constrained by:

- Thermal unit retirements due to public policies and economics

- 40 GW of existing generation at risk of retirement by 2030 – 21% of current PJM installed capacity

- PJM interconnection queue backlog

- Intermittent- and limited-duration resources represent the vast majority of generation in the PJM queue, requiring multiple MW of these resources to replace each MW of thermal generation

- Slow pace of new power generation builds

- Need for transmission line upgrades and expansions and related lengthy buildout delays

- Capacity market dysfunction

Conclusion

- Natural gas prices are low because of oversupply

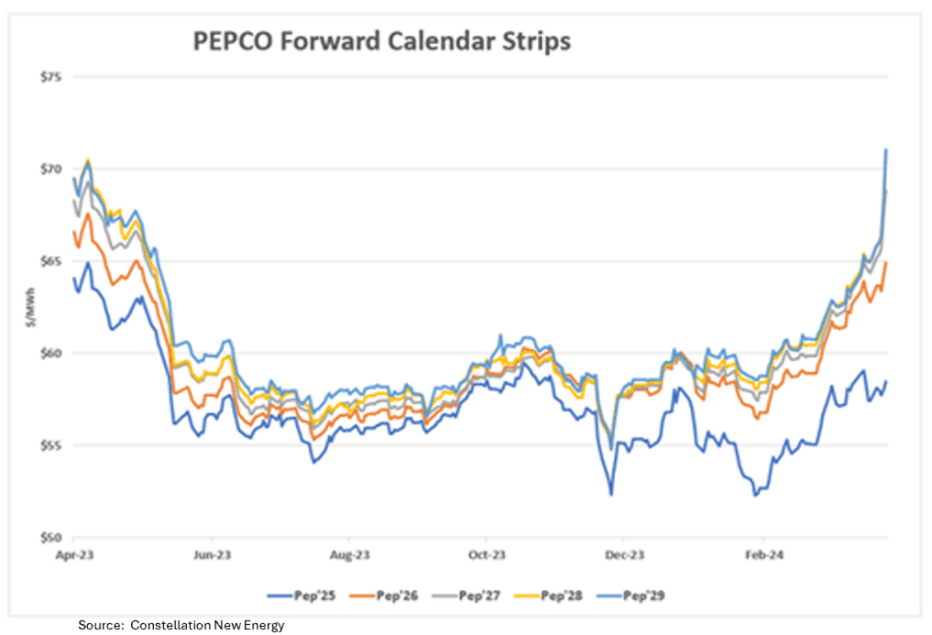

- Electricity prices are elevated due to demand growth projections and difficulty in adding new generation

- There is uncertainty in the PJM electricity capacity market

- The correlation between natural gas prices and electricity prices has weakened

- There is more upside to electricity prices than downside

Avalon Energy Services can help you navigate your way through this uncertainty.

The Avalon Advantage – Visit our website at www.avalonenergy.us, call us at 888-484-8096, or email us at info@avalonenergy.us.

Please feel free to share this article. If you do, please email or post the web link. Unauthorized copying, retransmission, or republication is prohibited.

Copyright 2024 by Avalon Energy® Services LLC